april 2016 service tax rate

Presently in cases where the amount allocated for investment or savings on behalf of policy holder is not intimated to the policy holder at the time of providing of service an insurer is required to pay tax 35 of the premium charged from policy holder in the first year and 175 of the premium charged from policy holder in the subsequent. Changes applicable from 1st April 2016.

What Is The Rate Of Service Tax For 2015 16 And 2016 17

Refer point of taxation article for further clarification.

. Some of the changes were made effective from March 01 2016 itself like withdrawal of exemption on services to monorail or metro exemption to specified services provided by the IIM retrospective Service tax exemption allowed on certain contracts etc flurry of changes are yet to make their advent from April 1 2016 and many others will come into. New Service Tax Chart with Service Tax Rate of 15 Service tax rate increased from 145 to 15 increase by way of levying Krishi Kalyan Cess at 05. Changes in Abatements wef.

Read customer reviews find best sellers. Concession of 3 will be available thus making the effective rates as 15 21 and 27 pa. Your 2021 Tax Bracket To See Whats Been Adjusted.

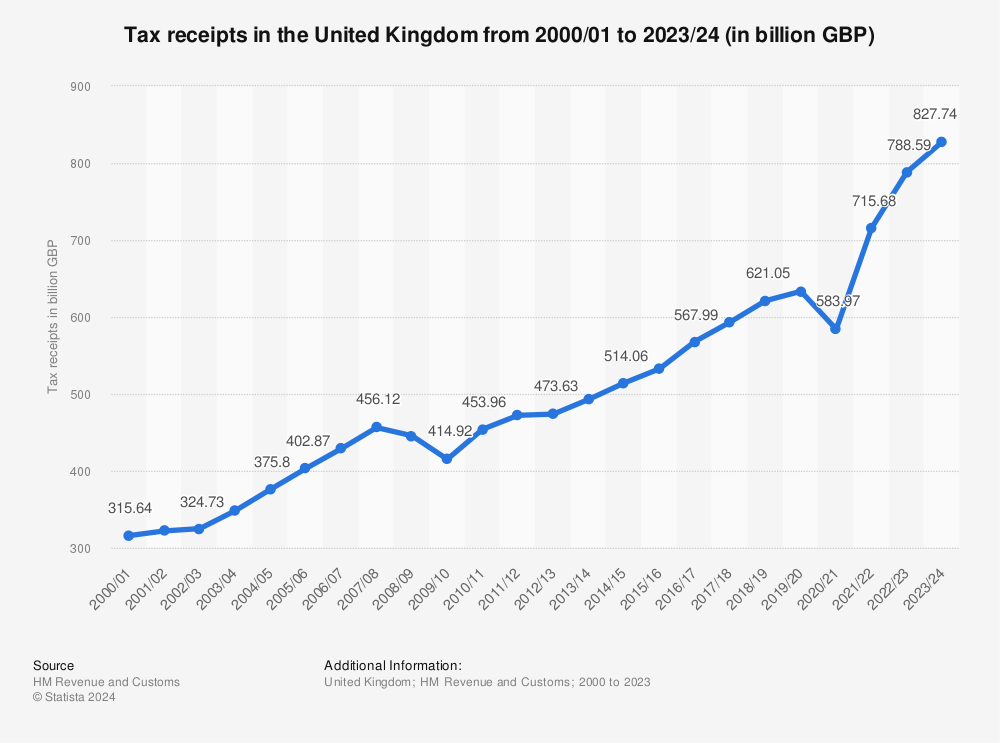

Service tax rate chart for fy 2015-16 wef 15 nov 2015 with new service tax rate 145. For the tax payers with value of taxable service less than 60 lakh rupees in PFY interest rate for delayed payment will be 12. For detail article about service tax changes applicable from 1416 read here.

Discover Helpful Information And Resources On Taxes From AARP. Service tax abatement rate wef 01042016 after budget 2016 0 0 RAJ KUMARI Saturday March 5 2016 2016-03-05T0901000530 Edit this post CHANGES MADE IN NOTIFICATION NO. 12 was the basic rate 2 was Education Cess and 1 was Secondary and Higher Education Cess.

The Said change will be effective from 1st June 2016. Free shipping on qualified orders. Service tax rate 145 is applicable for period during 142016 to 3152016.

Service Tax Basic Rate -14 Swachh Bharat Cess 05 wef. While Swachh Bharat Cess was levied to conduct a cleanliness drive in India the new cess has been levied to finance and promote initiatives to improve agricultural growth. Ad Browse discover thousands of brands.

From 142016 service tax is leviable on 30 on amount charged for service of transport of passengers by rail without availability of cenvat credit of inputs and capital goods. 142016 vide Notification 82016-ST dated 01032016. Any other changes in service tax rate w e f 1st April 2016.

From 15112015 Krishi Kalyan Cess -05 wef from 01062016. Till 31 May 2016 the Service Tax rate was 145. Earlier till 31st May 2015 the service tax rate was 1236.

Service tax rate chart. Full information on Krishi Kalyan Cess and its applicablility. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Service tax rate chart for fy 2016-17 with service tax rate 145 upto 1st june 2016. With Krishi Kalyan cess the service tax would increase to 15. Cenvat credit of input services are now available.

From 1st June 2016 onward the new rate of service tax is 15 due to the introduction of Krishi kalyan Cess 05. Ad Compare Your 2022 Tax Bracket vs. Description of service provided Existing Taxable Value Taxable value after amended Abatement 2 Transportation of goods by rail by Indian Railways 30 without Cenvat credit 30 with input service Cenvat credit 2A Transportation of goods in containers.

Free easy returns on millions of items. Complete IRS Tax Forms Online or Print Government Tax Documents. Change in exemptions from service tax from 1st april 2016.

In above chart replace 15 with 145 in above chart to calculate old rate. Any other changes in service tax rate w e f 1st April 2016. 262012 ST ABATEMENT NOTIFICATION OF SERVICE TAX BY NOTIFICATION NO 82016 DT 1ST MAR 2016.

30 rows new service tax rate chart for fy 2016-17 with service tax rate 15 from 1st june 2016. April brings local rate changes a state rate change and a new Internet sales tax. 14052003 09092004 8 10092004 17042006 1020.

Pin On Inventory Management Software India

What Is Gst Goods Services Tax Details Benefits

/dotdash_Final_Current_Account_Deficit_Apr_2020-01-ca5e0d6c1ea440d68503f7730d2d5675.jpg)

Current Account Deficit Definition

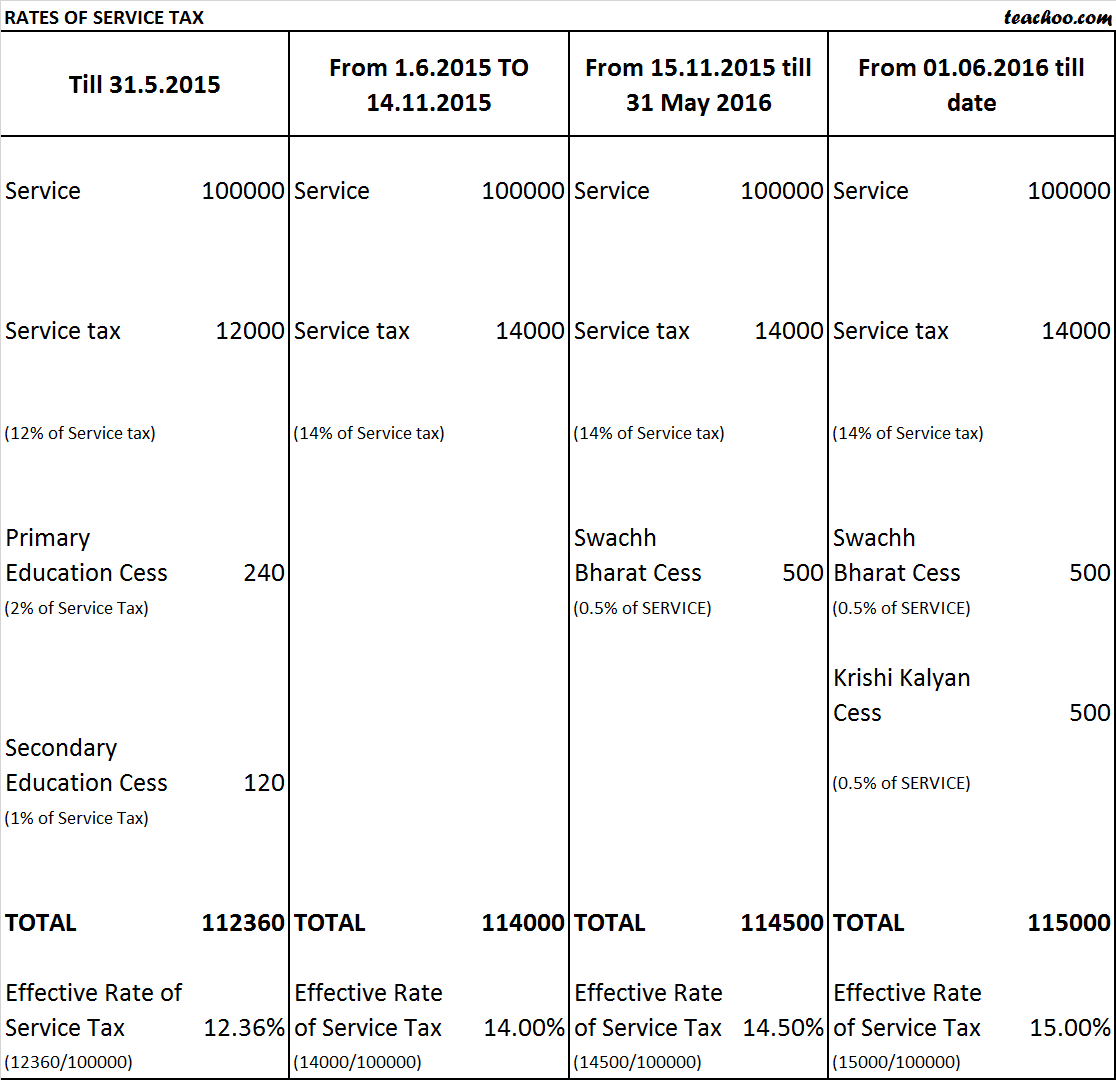

Tax Interpretation Manual Provincial Sales Tax Act General Rulings Province Of British Columbia

Meaning Of Sgst Igst Cgst With Input Tax Credit Adjustment Sag Infotech

Chapter 7 Moving Forward Together On Reconciliation Budget 2022

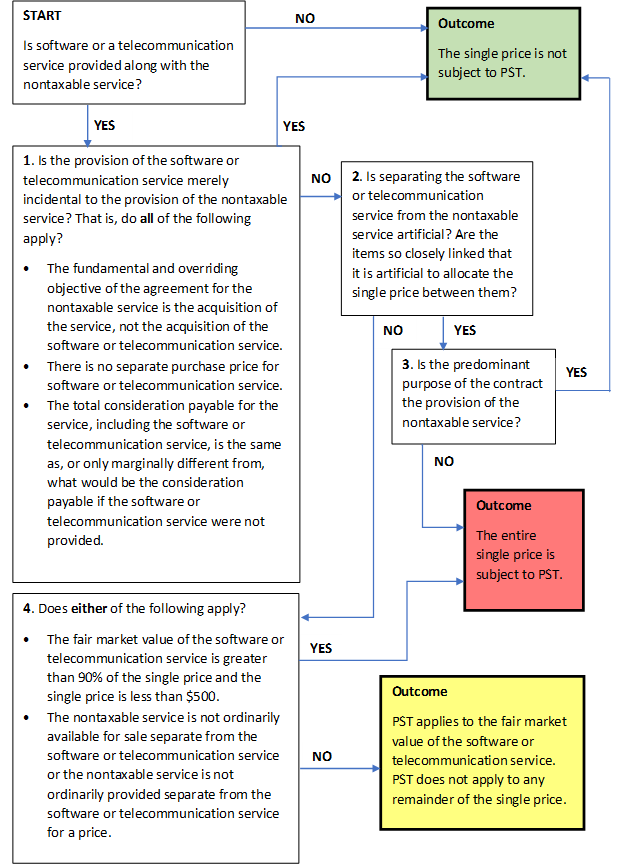

Sales Graphs And Charts 30 Examples For Boosting Revenue

F Y 2016 17 Due Dates Of Service Tax Tds Tcs Central Exxcise Cst Vat Pt Esic Pf

Tax Principles Relx Information Based Analytics And Decision Tools

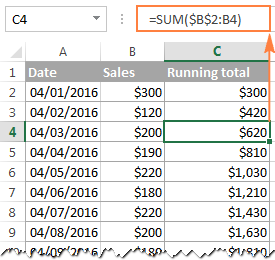

How To Do A Running Total In Excel Cumulative Sum Formula

Taxtips Ca Business 2020 Corporate Income Tax Rates

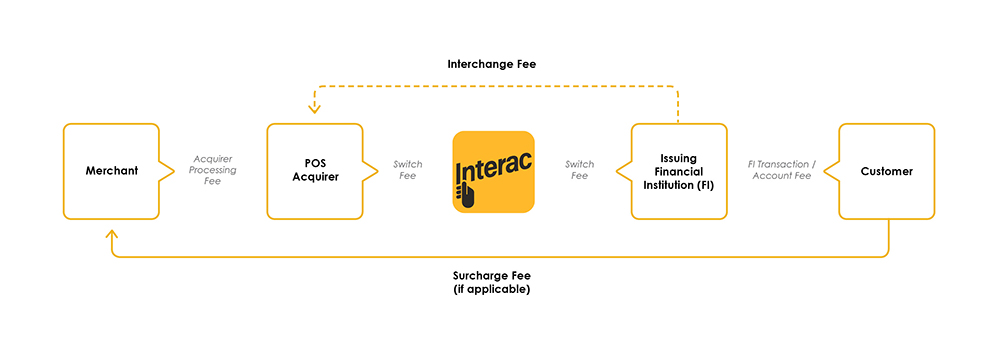

Learn About Our Solutions Fee Structure Business Interac

Gst Rates 2020 Complete List Of Goods And Services Tax Slabs

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

Gst Rates 2020 Complete List Of Goods And Services Tax Slabs

The Impact Of Gst On Varied Business Areas Gst Gstbill Business Tax Goods And Service Tax Business Challenge